Top 3 Answers that CoinJar Customers Got Wrong in the Scam Awareness Quiz

For the end of Scams Awareness Week, we're reviewing the quiz results and the top 3 questions on the quiz that tripped up even the most scam-savvy of participants.

But first, congrats to Wayne from Madeley for winning the iPad!

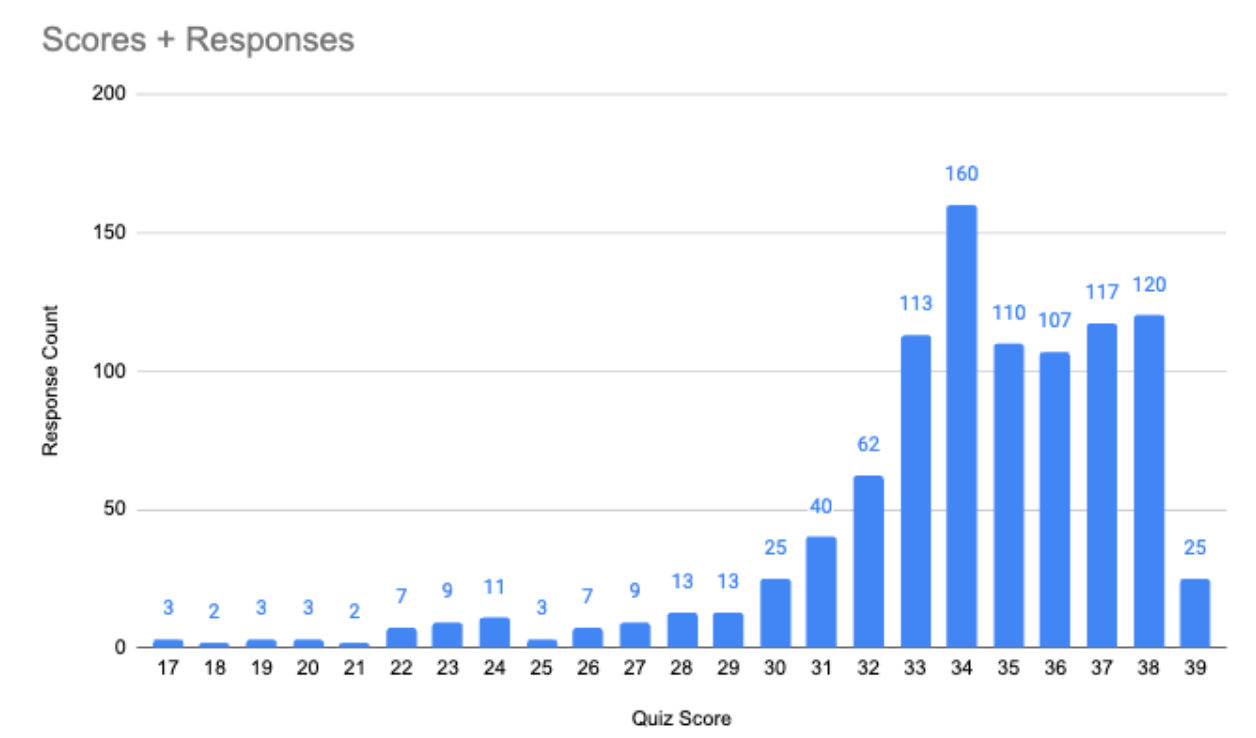

What were the quiz results?

Here's the rough score breakdown from close to 1000 entries:

- 91% of respondents scored 75% or higher on the quiz

- 0.8% of respondents scored 50% or lower on the quiz

Let’s review the top 3 questions that tripped people up.

Question 5 – A Heart-Tugging Hoax

Question 5 asked if the above image was a scam. The correct answer is yes.

10% of respondents got this answer incorrect, the second highest percentage of wrong answers for this quiz section. It may seem genuine, but it's a financial scam disguised as a charitable plea. Here's what we can learn from this ad to help you recognise it as a scam:

- Emotional manipulation: Scammers often use emotional stories, like that of a sick child, to quickly grab people's attention and disarm their scepticism.

- Urgency and isolation: The ad creates a sense of urgency and isolation ("I am alone with Nastya so far from our home and I feel so lonely now..."), a common tactic scammers use to compel quick action without thorough scrutiny.

- Lack of verification: Legitimate charitable organisations will have verifiable information available. A genuine ad would typically be linked to an official page verified by the platform (Facebook, in this case), and there would be external sources to confirm the legitimacy of the cause.

- Solicitation for direct donations: Scammers often ask for donations to be made directly to a cause without providing proper context or verifiable paths. Authentic charities usually direct potential donors to official websites or established, secure payment methods.

In this case, the domain listed in the profile has since been taken down by the domain registrar as further evidence that the site was not genuine. In addition, any donations made to this service may ultimately end up in the hands of malicious or illegal operations, such as sanctioned entities.

Question 12 – Will the real CoinJar please stand up?

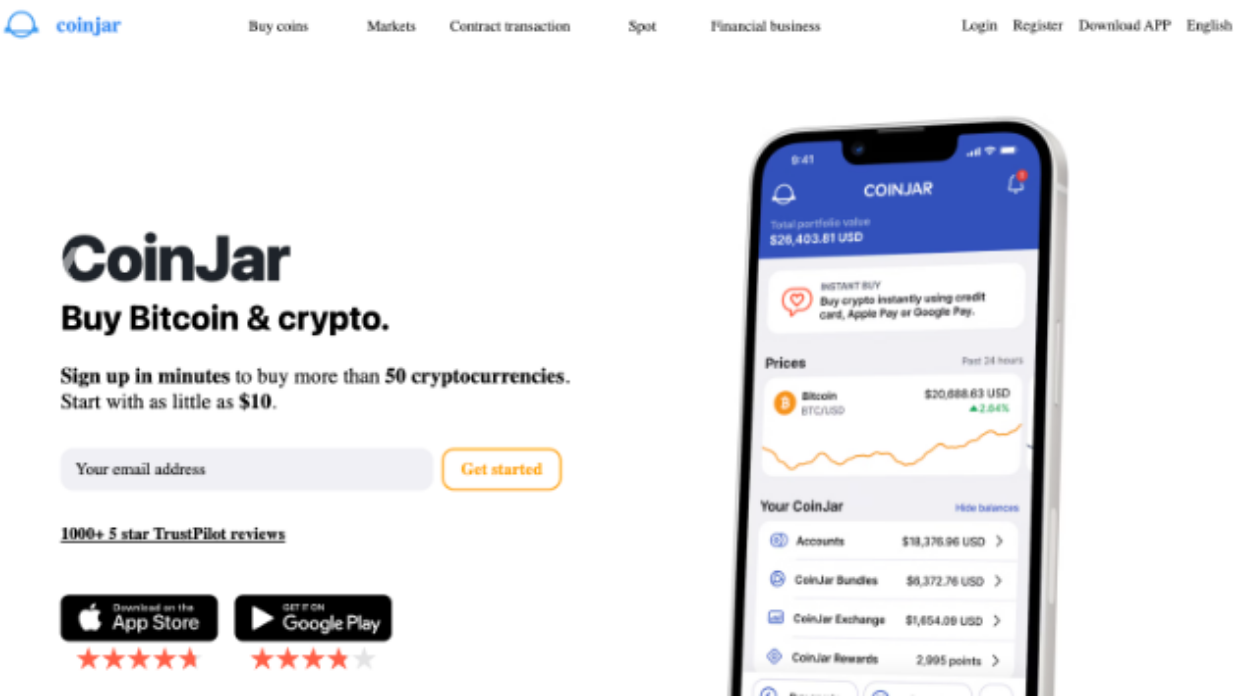

Question 12 asked if the above image was a scam. The correct answer is yes.

23% of respondents got this answer incorrect, which is an extremely concerning amount. It shows that impersonation scammers are getting smarter, making it far easier for unsuspecting people to fall victim.

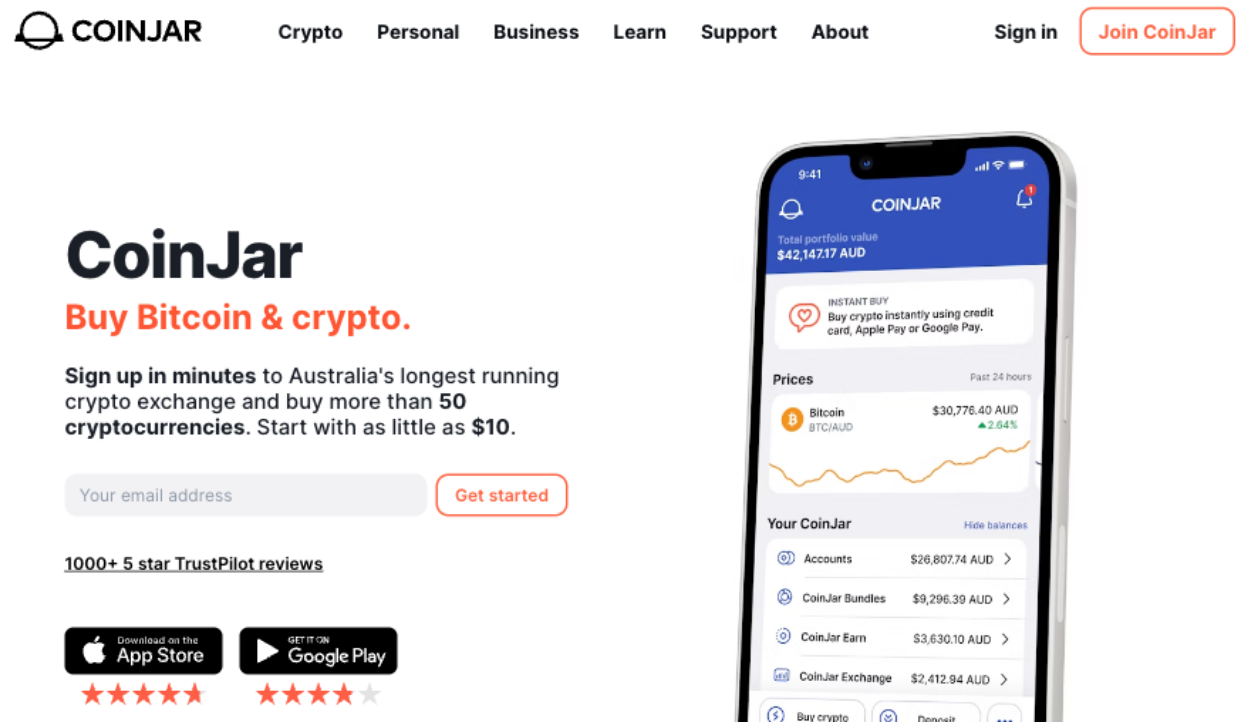

The image above is not the actual CoinJar website. For comparison, below is the real CoinJar:

The differences are subtle but noticeable if you compare it against the official website. Impersonation scams can be very sophisticated. They can appear as sponsored ads on social media or search engines.

How do you make sure you've visited the right website?

- Check the URL Carefully: The official website will have a secure and verified URL. Look for 'https://' at the beginning and verify that the address is correct (e.g., www.coinjar.com and not a misspelt variant like www.coinjer.com).

- Use Official Apps: Download CoinJar's app from official sources such as the Apple App Store or Google Play Store rather than from links in emails or other websites.

- Double-check with Official Customer Support: If in doubt, contact CoinJar's official customer support through their verified channels to confirm the website's authenticity.

- Look for Poor Design or User Interface: Scam websites often look unprofessional or have a poorly designed user interface or out-of-place images/text/fonts. If it doesn't match CoinJar's official branding, be cautious.

- Use Bookmarks: Bookmark the official website after you've confirmed its authenticity. Use that bookmark whenever you wish to visit.

Question 24 – The Padlock Paradox

Question 24 posed the following statement:

All websites with a padlock icon next to the URL in the address bar are safe and secure.

20% of respondents said yes, although the correct answer is no. The truth is that more and more scams are using the padlock icon (also known as a website with a valid SSL certificate) to prove their legitimacy.

The padlock icon next to a website's URL in the address bar has long been a symbol of trust and security, signalling that the connection between your browser and the site is encrypted. However, it's essential to understand that while this indicates data is transmitted securely, it does not necessarily mean the site is trustworthy.

Cybercriminals are increasingly adopting SSL certificates, enabling this padlock display to give their fraudulent sites credibility. This misuse has diluted the padlock's assurance, making it just one of many indicators of a site's integrity rather than a definitive green light.

Encryption only ensures that data is protected during transmission; it does not validate the intentions of the person or organisation behind the website. Thus, a padlock icon does not guarantee that you are not on a phishing site or that the content is legitimate. These sites might still be fronts for scams, host malware, or trick you into divulging personal information.

As always, it's essential to report anything suspicious or unusual, as it may be a scam.

What do the results say about scam awareness?

- Emotional manipulation breaks down barriers: Scams that use emotional manipulation can easily confuse or trick people into getting involved.

- Impersonation scams are getting smarter: Scams that impersonate genuine brands, services or products are getting better at impersonating the real thing and by extension, making it easier for people to fall victim.

- The 'padlock' icon is no longer reliable: These days, it's easier to obtain (or create) an SSL certificate to display the famed padlock icon on a website, but it's no longer an indicator of the site's legitimacy.

Making a report

Scams can be stopped, but we need your help to do it. You can help stop the scam and help warn others by reporting the scam to the National Anti-Scam Centre via Scamwatch.gov.au.

By reporting scams to Scamwatch, you help protect others and disrupt and stop scammers. The reality is 30% of scams currently go unreported.

The information you share to Scamwatch helps the National Anti-Scam Centre identify the scams causing the most harm to Australians.

Your scepticism and diligence are paramount in this digital masquerade ball, where scammers are constantly evolving their tactics. Always remember, in the face of impersonation, it's not just about spotting the scam; it's about outsmarting it. Stay alert, stay informed, and stay safe.

If in doubt...

If you’re unsure about something, contact CoinJar Support. We’re constantly monitoring suspicious wallets and websites and can help you work out whether something is a scam or not.

Thanks for joining us for Scams Awareness Week 2023 - we’ll see you next year, but you should always be vigilant.

Stay safe,

CoinJar Team

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).