Offchain: Move-to-Earn is so 2022, how to-earn in 2023

Move-to-Earn is so 2022, how to-earn in 2023. Not all earn programs are created equally - here's what you need to know.

For a while, all crypto founders had to do to attract an audience looking for quick money was to create (any activity)-to earn projects. Now that we've been through the decline of play-to-earn, move-to-earn, and even sleep-to-earn, it's time to be realistic. Earning interest on your crypto in 2023 hits differently. Especially when there's Gary in the US doing little to provide guidance for crypto businesses - even those listed publicly.

It wasn't just random web3 projects with questionable to-earn tokenomics that didn't make it out of 2022 well. Other platforms promising users earnings on their crypto holdings did even worse. Thanks for nothing, Celsius - the crypto lender that supposedly generated interest for users by lending funds to institutional investors - but instead just burned through cash and ruined crypto's reputation further.

As so often in crypto, what they promised was simply too good to be true. Luckily not all yields are made out of thin air.

Earning in DeFi

DeFi offers a variety of ways you can increase your crypto.

The most popular way to earn in DeFi is by providing liquidity to decentralized exchanges or to borrowing platforms. Liquidity makes the DeFi world go round. Being an LP in DeFI is a bit like being a limited partner in a VC, or how the author imagines it to be. You give money to someone, and ideally, something comes back.

On DEXs

Decentralized exchanges (DEXs) rely on crypto provided by so-called liquidity providers (you if you deposit into them), who lock up their tokens in pools in return for a share of the trading fees generated. Whenever someone trades the tokens in the pool, for example, UNI-ETH, part of the fees goes to those who locked their UNI and ETH in the pool.

The money you earn is the fees people paid for using the DEX.

Examples of DEXs where you can add your tokens to earn this way include Uniswap, Pancakeswap (if you're more into cute food-themed exchanges), and Curve.

For lenders

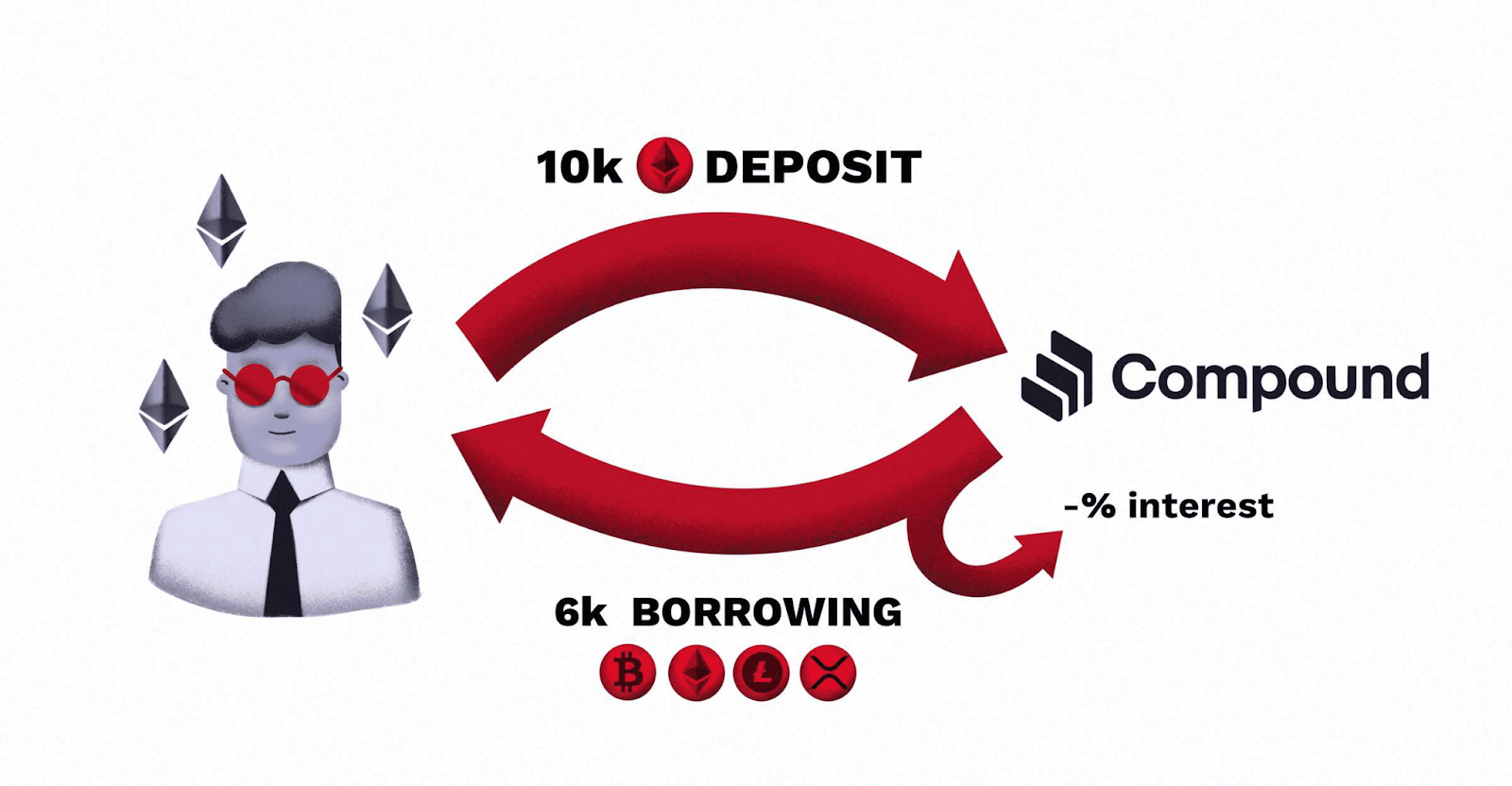

Another way to earn in DeFi is by supplying your tokens to lending and borrowing protocols like Compound.

Compound launched in 2018 as one of the first lending and borrowing protocols on Ethereum. When depositing funds in Compound, they are pooled and made available to borrowers. To ensure that even in the case of a market crash, lenders don't lose funds, borrowers are required to add collateral exceeding the value of their loan. That makes sense for institutions and individuals looking to hedge, leverage, or pay for things irl without giving up on their crypto.

Earning this way means earning through interest paid for by borrowers - a business model well-established in TradFi.

Staking

Proof-of-Stake protocols reward people running nodes and validating transactions on their network with native tokens. If running a validator yourself seems like a tough ask (it is!), you can also delegate your stake, and earn that way, tap into staking protocols, or use crypto exchanges' staking programs.

Passthrough Earn Programs

Centralized platforms' earn programs aren't all the same. While some pool users' money and invest it without providing transparency on how yields are generated, others rely on pass-through mechanisms. As the name suggests, pass-through means they will pass on your funds to DeFi protocols like Aave, Compound, or directly stake it. Passthrough has the benefit of providing ease of access to DeFi without limiting one's ability to withdraw funds.

Exchanges offering earn programs based on pass-through include Coinbase and CoinJar (not available in the UK) . To finish where we started - passthrough leverages resilient DeFi infrastructure to earn and gives the SEC fewer grounds to attack.

So, if you decide to earn on your assets, just make sure you know where your earnings come from, and enjoy the ride 🎢

Naomi from CoinJar

Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).