Offchain: Stop being a Degen; become a Regen

What ReFi is all about, and how regens want to make the world a better place.

Maybe you spent the Easter holidays talking to your non-web3 friends about crypto. Chances are they:

- told you to stop talking about it

- asked why it was that their acquaintance lost a lot of money in it or

- dismissed it as something boiling the oceans and worth banning altogether.

I'm not saying you should ruin people's holiday experience by trying to convince them otherwise, but of course, neither are all blockchains the same nor are all people working in crypto really just in it for the tech or money.

There is one subsection of people in crypto that want to change the world. And they go by the name Regens. Regen is a play on the word generative and degenerate; Degens typically being the people in it for the money and with little risk management.

Regens, on the other hand, care more about building out the ReFi ecosystem.

From DeFi to ReFi

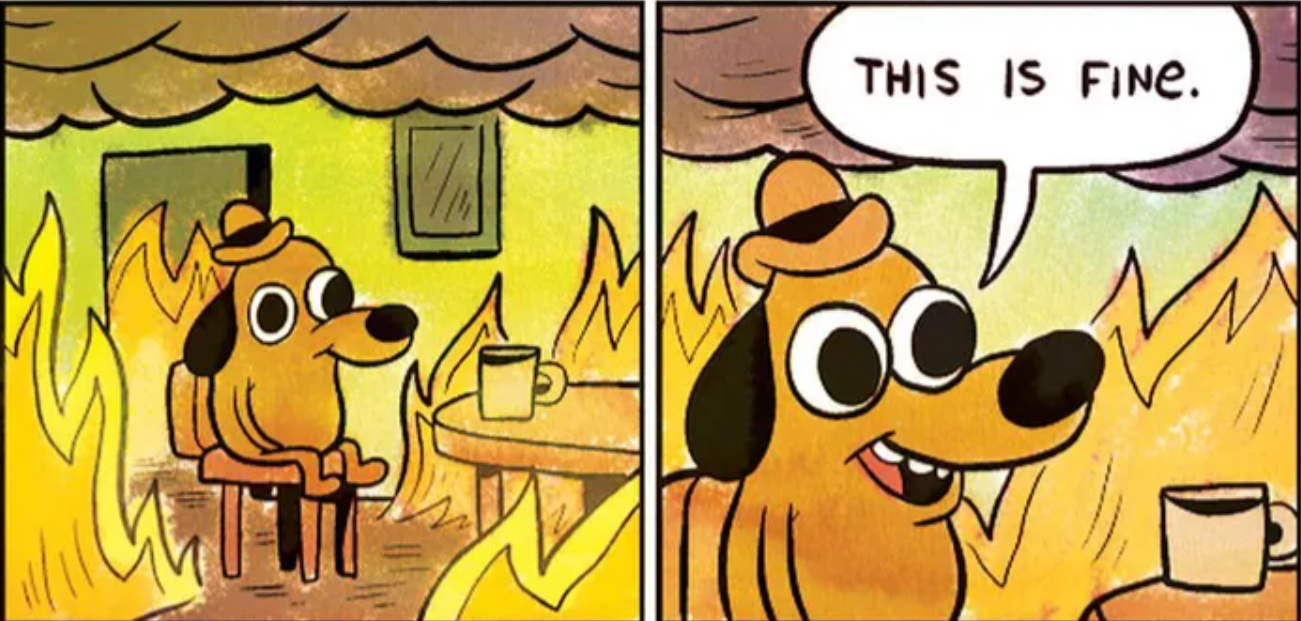

ReFi is based on the idea of using blockchain for more than just financial gain because are you really going to care about those when the world is on fire? 🔥

Instead of gains, Regens are more interested in establishing mission-driven projects leveraging blockchain to address climate change, biodiversity loss, and the structures behind it.

While the traditional financial system is working in extractive and exploitative manners - just ask your local Amazon couriers how they are doing - ReFi hopes to build on the idea of regenerative capitalism to build better. Instead of focusing on achieving growth at all costs, ReFi emphasizes making meaningful changes and enabling juster societies.

At first, it might sound like hippie dreams, but they are onto something, as the popularity of concepts like doughnut economics and ESG proves.

ReFi in practice

In practice, ReFi is based on a simple idea: creating systems that can restore themselves. One concern for Regens is rethinking money, understanding it not as a means in itself but as a tool to incentivize actions that align with regeneration.

Another big area for ReFi projects has been the carbon credit market, with projects like Toucan and Klima DAO hoping to bring accountability and transparency to the currently opaque market.

Beyond just offsetting existing carbon, projects like Reneum focus on enabling the transition to renewable energies, Wilderlands protects and restores natural ecosystems and biodiversity, and Open Forest protocol facilitates the tracking of forest land with a focus on maintaining and fostering new trees.

But not all of ReFi addresses are about climate either.

One of the most well-known companies in this area is actually Gitcoin - an organization spearheading how we can better fund public goods. Instead of giving control to politicians who currently decide what gets funding, Gitcoin empowers each one of us to vote for the projects we believe to be worth it. While most of the projects funded through it are currently focused on building digital infrastructure, if the mechanism works, it might support IRL goods and investments soon.

While ReFi is still early and the term is broad, there is a solid builder community in it, with the Layer-1 Blockchain Celo dedicating big chunks of their vision to this particular section of web3.

So if you're tired of being a Degen and feel like you prefer doing some good, why not get into ReFi? 🌱

P.S Make no mistake, though, you still have to do your research because people like Adam Neuman have (mis)used the ReFi narrative to fund questionable carbon credit web3 projects - or was it all a Robin Hood play to rid az16 of millions? We'll have to wait for the Netflix documentary to find out.

- Naomi from CoinJar

Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).