Onchain: Just another normal week in crypto

Dare I say, such a thing does not exist. While another exploit and another outage aren't big news to us anymore, the first story at least led to some hated arguments. And what are we here for if not drama?

Story One

Frontrunning the frontrunners

One of the features of the Ethereum blockchain is that unfinalized transactions are publicly visible before they get included in blocks and executed. This makes it a perfect place for front-running and arbitrage trades whereby the block builders re-order transactions to squeeze the most value out of users.

While it sounds like a despicable practice, instead of removing it, the Ethereum protocol doubled down with the introduction of MEV (maximum extractable value) boost, a software maximizing what can be extracted, which pretty much everyone is using now. After all, not using it is like walking past money lying on the street.

Things got even more interesting when the US courts decided to convict two brothers who had front-runned the front-runners. By exploiting a vulnerability in MEV boost, they managed to get off with $30 million. Of course, they did not help their case by using shell companies and other shady techniques to obscure the origin of their funds.

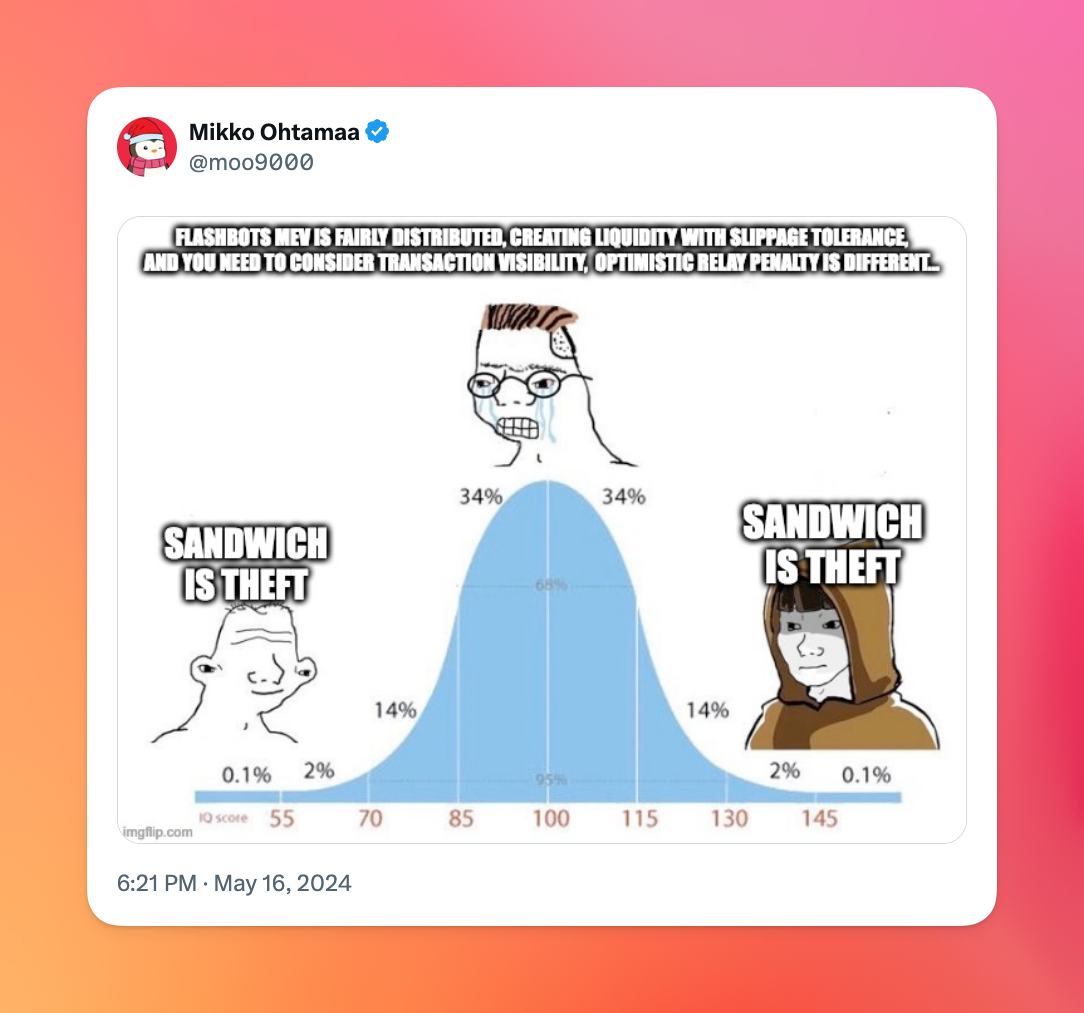

All of this raises an interesting question, though: When is MEV illegal? Some believe that this judgment won't have a direct impact on the software. Others are less optimistic, fearing it could legitimize front-running and sandwiching.

Takeaway: There used to be a website where you could see how much you had been sandwiched. It's offline. I'm not a conspiracy believer, but that timing is indeed suspicious.

Plus, I am of the view that sandwiches are best left in the culinary realm.

Story Two

Another exploit

This time, the exploited platform was pump.fun, a deeply professionally run platform, as the name indicates.

With meme season on Solana, pump.fun has become the prime venue for anyone looking to launch a memecoin without knowing how to code. All it takes is the ability to click a few buttons and make a transaction.

A hacker exploited the memecoin issuance process by withdrawing the initial liquidity provided ahead of DEX trading. This time though, it was a hack for ants with just $2 million lost and all user wallets secured by a quick reaction from the team. Investigation so far hints at a private key exploit, suggesting it might have been an ex-employee.

When Memes went back online, the pump continued as if nothing had happened. Solana hit a monthly high straight after.

Takeaway: Maybe this hack was just another part of the entertainment package of the Solana meme casino. As Postman would say, we're amusing ourselves to death.🤡

Story Three

Another outage

Ex-Boyfriends 🤝 L3s

"But this time, it's different."

It never is. I've not been shy about my lack of conviction in L2s as long as they have centralized sequencers that take more breaks than the American worker and lack fraud proofs. By that logic, every CEX is an L2 and potentially a more reliable one.

But there's now a new opponent in town: L3s. Articles with titles like How L3s are the future of Scalability are popping up, and all you can do is wonder at which Layer we will stop.

Nietzsche once wrote that we can learn a lot about a man from the way he builds a castle in the sand. The one joyfully constructing it without reward for its inevitable loss was, for him, the exemplary human. As such, we can frame Degen chain builders, who are indeed building their L3 on top of fallible L2s.

I mention this outage only because it's probably the first big L3 outage we've had.

On May 12th, the chain's biggest infra provider reported an outage due to a configuration change. This change led to 5 addresses flooding the network with a high volume of failed transactions, bringing block production to a halt. 50 hours later, things went back to normal. The Sand Castle lived to see another day.

Takeaway: It would seem that more layers cannot fix it.

Fact of the week: Since I got hungry when writing about sandwiches, did you know that they were named after a real person? Lord Sandwich was an avid gambler, and since he didn't have time to eat during his play, he'd ask servants for meat squeezed in between slices of bread. Sounds like he'd make a good degen.

Naomi for CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).