Crypto Realism

In his essay Capitalist Realism, Mark Fisher establishes that we've canceled the future and are just recycling the old instead. And what's old in crypto? Discussing who Satoshi is, viewing memecoins as community coins and incompetent projects with million-dollar backing... Crypto is having its recycling moment this week.

Story One

The Big Reveal?

The go-to driving force of modern men is the urge to dissect anything into tiny pieces, digging for an acceptable truth. Not even the seemingly untouchable creator of Bitcoin is safe from such desires. And so HBO decided to use a reveal of Satoshi Nakamoto's identity to drive viewership for their upcoming documentary.

Of course, ever since the disappearance of Satoshi, people have been wondering who he was, with theories ranging from cypherpunks to the CIA. Then appeared Craig Wright, claiming to be Satoshi, but ultimately, even the normie judge had to rule that out since the claimant had no evidence to back himself up—an expensive hobby for the wannabe.

Will the HBO documentary reveal anything new? By the time you're reading this, it'll have aired and we'll know for sure (scheduled for October 8th at 2 am CET..). In the meantime, betters on Polymarket estimate that Len Sassman, a cypherpunk who committed suicide at the age of 31, will be the one revealed with a 48% chance.

Takeaway: The myth around Satoshi is strong. Why ruin that? Clearly, he's had a strong desire for privacy, and with the increase in assaults on crypto holders, do we need to give them more targets? I don't think so. Get over it and go back to birdwatching...

Story Two

Memecoin Supercycle

Remember the supercycle? It was an idea by 3AC founder Shu Zu that stated the crypto markets would go up without a sustained bear market. Things didn't play out like that, and even Su had to admit he got it "wrong".

Enter the new super cycle, the one that's taken over crypto Twitter by storm, gobbled up by unimaginative reply guys.

Introduced by Murad, a crypto thought leader, the memecoin super cycle is a thesis based on a recent resurgence of people pouring their funds into memes - disregarding tech and valuations. Who needs market cap math, when you can decide based on whether a ticker looks good or not?

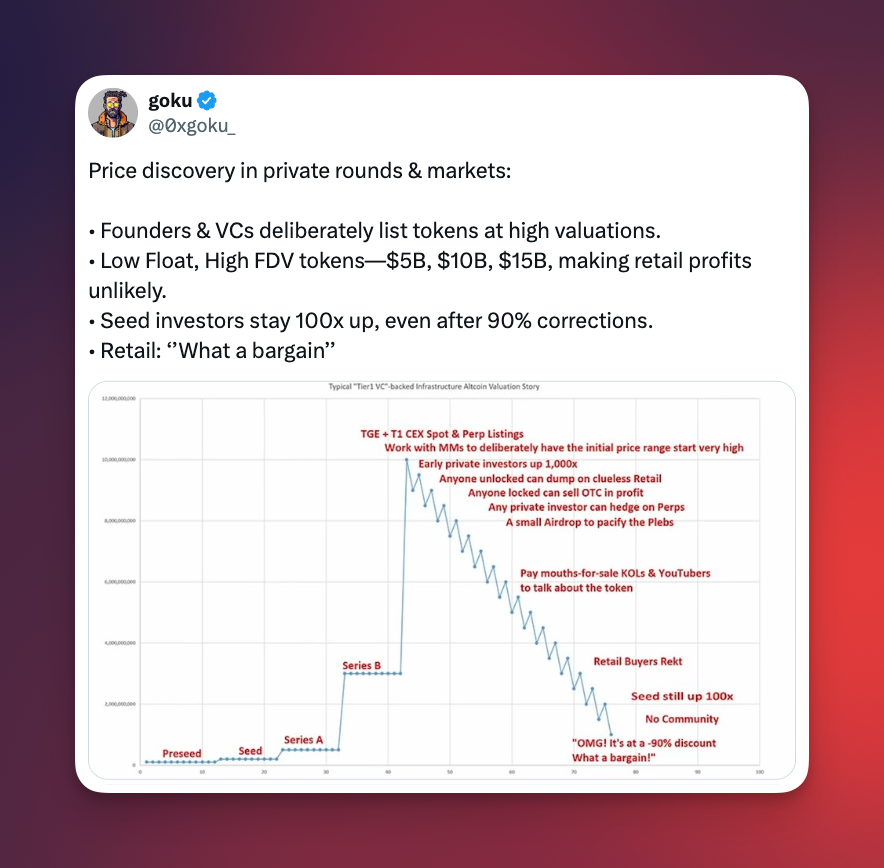

And it's not all financial nihilism, either. The memecoins utility isn't the tech. It's the frens we make along the way, the feeling of belonging, that - even if just for a short time - glosses over the existential dread we have since Nietzsche declared God dead. It's also a recognition that the life-changing gains aren't attainable in a world of heavily inflated valuations.

Takeaway: God might be dead, but at least we got our memecoin cults. Still, if you want to join a subcult, I'd urge you to get into running or biking, the cult for guys over 30, instead. It'll be better for both your mental and physical health. Trust me.

Story Three

Nothing to see here ...

Live view of the Eigenlayer team over the weekend.

Eigenlayer is one of those technically so sophisticated projects that you can't explain it like I'm five. It combines re-staking and data availability, with a pinch of Ethereum alignment. In short, a project beloved by VCs who poured $171 million in. Last week, the Eigen token went live, and after a short price increase, it started falling.

It didn't help that the supposed community airdrop favored whales, including Tron founder Justin Sun, who received $8.75 million. More like Eliterianlayer.

Things got even messier when the team shared they were investigating "unapproved selling activity". It turned out that an exploiter managed to send an email pretending to be an investor and receive 1.6 million tokens, which they immediately dumped.

As if that wasn't bad enough, it also proved that investors could sell if they wanted to - despite supposed lock-ups.

No one in their right mind uses MetaMask Swap.

Takeaway: Smart contracts exist. Instead of using them to enforce vesting, the team decides to just ask investors to sell respectfully. Pathetic.

Fact of the week: The third of October is the day of German unity. One reminder from the previous separation is the Ampelmannchen, a different version of the pedestrian traffic light. While unification nearly killed it, protests led to its continued use, and it's become a tourist photo op since.

West vs. East.

Naomi for CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).