Onchain: Celebrity coins, a Fintech coin, and a failed trademark application

Story One

Celebrity coins

If you've been following crypto for over a year, you'll have noticed that what holds true for the economic crisis, neon colors, and y2k fashion also applies to crypto: everything comes back eventually.

At least in real life, when trends from your youth come back, you can pat yourself on the shoulder for the foresight of keeping your retro glasses and record players. In crypto, the best is often to watch from the sidelines. The latest return of the celebrities is no exception. While Christiano Ronaldo launched another set of NFTs, other celebs have joined the pump fun on Solana. The Solana celebrity memecoin summer kicked off with the launch of JENNER, a coin Caitlyn Jenner promoted, having some fans wonder if she'd been hacked.

A few days later, coins by Iggy Azalea and Davido followed. So far, nothing out of the ordinary. However, things quickly turned sour when the celebs went on to allege the developer they hired, Sahil Arora, had scammed them. They were joined by Arora's former employees, who shared they hadn't been paid.

Now, some claim this is just a part of the propaganda spiel. After all, drama grows attention.

And if anyone knows that attention is everything, it's celebrities.

Takeaway: Some say it's good for adoption, but I'd say extraction isn't adoption. I didn't think I'd ever write this, but kudos to Paris Hilton. She's been the one consistent celebrity crypto endorser with a solid understanding of the tech.

Story Two

A Fintech Coin

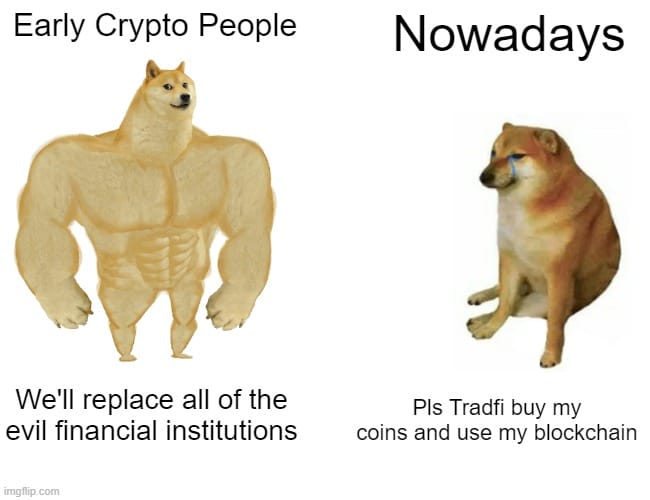

While early Bitcoiners wanted to replace the existing financial system altogether, we've matured to be enthusiastic whenever a big Fintech enterprise decides to touch our niche internet networks.

The online payment giant Paypal has deployed its PYUSD stablecoin on Solana after launching its first PoC on Ethereum last year. Chances are they experienced gas and getting frontrun for the first time and figured that's not a great user experience.

The launch is facilitated by a feature called token extensions, which allow the addition of custom logic to Solana tokens, such as memo fields and other programs that mimic existing FinTech features. As Solana says on its blog, "essentially compliance in a box."

And immutably onchain.

A cyberpunk's nightmare, a compliance officer's wet dream. 💦

So far, this stablecoin is far behind in adoption, with just over 100 holders and less than 450 transfers. Maybe once PayPal sets up all their merchants with USDC SOL addresses, things will change. Until then, there's simply no incentive to use PYUSD.

Takeaway: With now four large payment integrations (Visa, MasterCard, Shopify, PayPal), Solana looks well-positioned to capture whatever adoption happens in payments. And even if not, at least it helps rectify its image a little as not just a memecoin casino.

Story Three

Failed trademark application

Over the weekend, Crypto Twitter was once again in rage. This time, the trigger was a trademark application—not just any trademark, though.

Matter Labs, the company behind zkSnc, filed trademark applications in nine countries to trademark the term zero knowledge. At first glance, it seems rather stupid to trademark such a general term as intellectual property, but then, in crypto, idiocy is not a deterrent to success.

Zero-knowledge describes cryptographic protocols that allow someone to convince another of the truth of a claim without disclosing the underlying information. Countless crypto projects are using ZK-Proofs to compress information and enhance scalability. All of them felt bad about Matter Lab's initiative and took their anger to X and to a public letter in which they called for the withdrawal of the filing.

In the end, the backlash led Matter Labs to withdraw their application. After all, no one wants to be called an oppressor. 🤷

Takeaway: Asking the existing institutions to protect what many in crypto see as a public good wasn't the smartest move. Even if it was indeed done to protect themselves from dishonest actors, as Matter Labs stated. There is an issue with accountability in crypto, but chances are trademarks won't fix it either.

Fact of the week: Trademarks are mostly used to distinguish products and service brands, but they're also popular among celebrities. Interestingly, they don't die with them. The Michael Jackson trademark, for example, generates an average of $75 million per year.

Naomi for CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).