Offchain: 4 Things I Want Less Of Next Bull Market

The Bitcoin ETF has arrived and we’re working out what comes next. While we wait, I’m gonna yell at the clouds for a bit.

The ETF has arrived and we’re working out what comes next. While we wait, I’m gonna yell at the clouds for a bit.

Alright, the ETF dropped, price went up, price went down. It’s never nice when you cede ground, but at a mere 20% this could only possibly be described as a market dip for ants. Let’s drop the BTC price into the teens again, just so we can really feel alive.

Short-term price gyrations notwithstanding, it’s hard not to feel like forces are coalescing in that fizzing, crackling way that suggests silly season could soon be upon us once more – with all the good and bad that entails.

The ridiculousness of 2020/21 simultaneously feels like only yesterday and something that happened before the dawn of recorded history. Head back to 2017 and you may as well be describing a scene from the late Cretaceous.

But if we don’t learn from history, we’re doomed to keep thinking that the world is flat and flames are talking to us, so here are four things I hope we all agree to put in the bin for the coming cycle.

1. Hero worship

Look back at the anointed deities of the last cycle and basically the only people left standing are Coinbase’s Brian Armstrong and Tron overlord Justin Sun, who at this point in time has cheated death so many times he must surely be down to his final Horcrux.

SBF, Barry Silbert, Arthur Hayes, Do Kwon, Kyle Davies, Su Zhu, the Winklevoss Twins – at a certain point this shambling conga line of serial incompetents and straight-up fraudsters made up like 50% of any given crypto Twitter feed. They opined, they made bets, they bickered, they set the agenda. They told us things were good when they really weren’t. And now they’re all in jail, on the run, or just generally disgraced.

So, enough of that. The biggest thing Satoshi taught us is that blockchain technology doesn’t need great prophets – it speaks for itself. Now’s the time to let it do just that.

2. Absurdly complicated mechanics

I believe in crypto. I do. But I also recognise that if it’s going to change the world, then at some point it’s going to have to make itself a little more appealing to use.

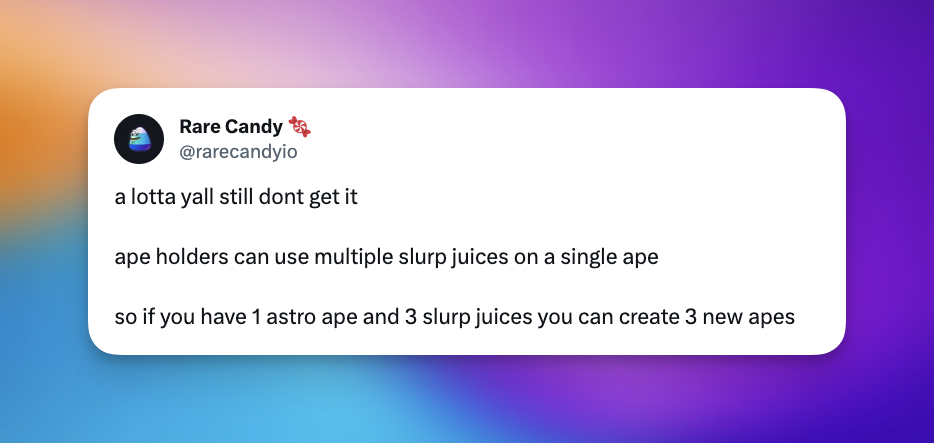

Crypto was already in trouble when the infamous slurp juice tweet became an instant meme, but given the timing it’s hard not to believe it single-handedly caused the LUNA meltdown a few days later.

Most people in this world are just focussed on making it through the day without falling over. Asking them to partake in an entirely new metaverse, one that’s only accessible via an arduous and expensive series of network linkages and abstract currency transfers, and that may or may not be populated solely by Nazis, ain’t gonna cut it.

Basically what I’m saying is let’s try and work out how we can improve the day to day of our users before asking them to commit to some unholy mix of escape room, foreign bank account and 3-day hallucinogenic bender.

3. Hundred million dollar hacks

Back in 2022 the only thing arriving with more frequency than crypto company collapses were $100+ million hacks.

The problem had been brewing for years, but everyone was making so much money it created the kind of moral hazard that led to the GFC – no matter how egregious the error, you could usually rely on some VC with deep pockets to bail you out.

How could the most secure digital technology ever invented become a byword for the worst security this side of a Medibank gettogether?

The problem is developers would use the infallibility of the blockchain as cover for their own shortcuts. “If I build an application on the blockchain, then it must be as secure as the blockchain itself,” they say as they install a multi-sig system where one person holds all the keys.

The issue is not so entirely different from number 2 up there – complexity creates problems, whether it’s in the user interface, or in the digital architecture powering it. But blockchain was meant to eliminate human frailty. This time around let’s make our own mistakes less of the story.

4. Bottom-feeding bros

This is probably too much to ask as Twitter/X/Elon’s Beautiful Dark Twisted Fantasy crumbles further and further into an outright parody of itself. But it would be nice if the visual representation of the average crypto user wasn’t the kind of loud-mouthed, wannabe dick-swinger whose crippling-insecurity-as-big-car-machismo shtick is so exaggerated it verges on performance art.

I know you’re never going to get rid of them entirely – these bona fide beta boys are part of the beautiful multihued tapestry that is humanity, etc – but surely this time around we can start reaching new audiences and the concept of the crypto bro will stop holding such salience.

Crypto’s whole thing is democratisation and equality of access. Time to start inviting people in.

Luke for CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).