Onchain: The Future of France

Whenever prices go up, we're seeing a renaissance of everything that makes crypto such an aspirational, deeply respected industry. From new token standards no one asked for (akin to the castles built by the monarchs while the peasants starved) to the metaphorical cake 🍰 (airdrop tokens) we're offered in return for locking our hard-earned internet money, it makes you wonder: Is the future of France Finance also the past?

Story One

Ru(i)nes

Men will launch new token standards on Bitcoin instead of going to therapy. I reckon the only way to end this is by launching a "therapy-to-earn" dApp.

Just in time for Bitcoin Halving, the developer behind Ordinals, the first token standard on Bitcoin to make a splash, has created Runes. It's a protocol that facilitates the issuance of fungible tokens on the Bitcoin blockchain.

In practice, the process of creating Runes is called etching and consists of storing a special message in the transaction outputs (the way bitcoin tracks people's holdings and ability to spend). Since the protocol went live during the Halving, it set the stage for a battle for block space as everyone raced to secure the best names.

Good news for the miner who mined the halving block: in addition to the usual block reward, they also made $2.4 million on fees. The fees continued to flow, with people paying nearly $5 million in the first nine blocks since halving alone to secure quality mints like "Pepe wit Honkers".

Takeaway: It's nice to see that Bitcoin miners can still make money in this economy. Runes, however, seems more like a short-term game. There are only so many memes one can squeeze into the hard-coded 13-character limit, after all.

Story Two

Conviction

Legal systems getting involved in crypto are also having a renaissance in 2024, for better or worse. In this case, for better restoring some of the faith. This time, the judges found Avi Eisenberg, the trader who ran a highly profitable trading strategy on Mango Markets, guilty.

In October 2022, the accused stole $110 million from the Mango Markets protocol after manipulating the native tokens' price, exploiting a vulnerability in the code. While it's not uncommon for hackers to get away, just think of all the money North Korea has made; Avi had to brag on Twitter about it. Not only that, he even made a DAO proposal, offering to return part of the funds in exchange for a promise not to prosecute him.

Takeaway: He should have read about Louis XIV. Then, he would have known that "Pride goes before a fall." At least we're not using the guillotine anymore. One thing this has highlighted, though, is that Code is not Law. Law is law.

Story Three

The House wins

0 weeks without a rug. But not just any rug: this time, it's a project valued at $350 million not long ago. ZKasino is a decentralized gambling network that raised $26 million from investors, including MEXC. You see, it's a lavish spending season.

Retail started to pile in as soon as the casino opened its doors, putting in $33 million in ETH for the promise of a ZKAS airdrop. Depositors really believed they'd get their ETH back.

Oh, sweet child. It must have been their first cycle.

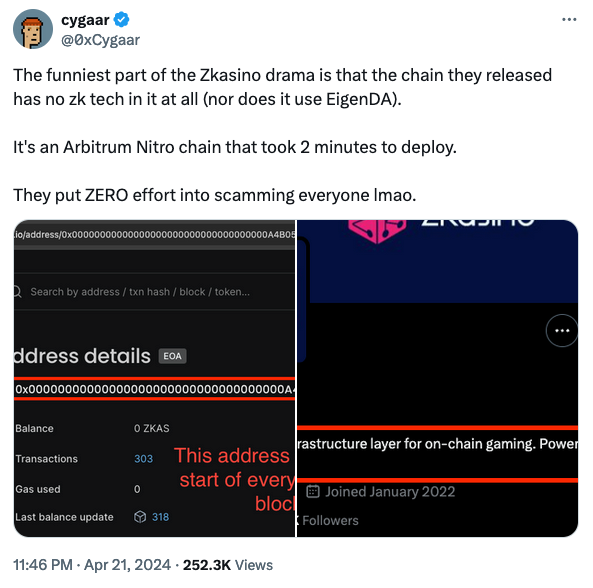

ZKasino really said, "Let em have ZKAS." Instead of allowing investors to redeem their ETH, they simply gave them ZKAS for a "seamless transition and superior user experience." It wasn't even a superior rug. Red flags were as numerous as in my ex. Blockchain sleuth ZachXBT alleged the team of mismanagement, and so did previous team members. Add to that the cancellation of their Dubai event and being audited by Certik and ChatGPT.

Plus, they didn't even use ZK.

Takeaway: As DeFizard put it, "it sounds like a scam, but 95% of crypto consists of such crap." The cynical conclusion then is that this might as well have been the next big memecoin. It didn't play out like that, and now here we are with the Zkasino team earning ETH on Lido while everyone who bought into their low-effort rug is left holding the bag. Not a great look for the industry. At least the French Revolution gave us art and music for centuries. This just gives us a bad rep.

Fact of the week: Even though the Let Them Have Cake line is often attributed to Marie Antoinette, there is no historical evidence that she actually said this. The first one to put the phrase into print was the French philosopher Jean-Jacques Rosseau in his semi-fictional Confessions, relating it to a great princess. Marie, at that time, was, however, still a child, so not likely the princess he thought of. Ultimately, revolutionaries using the quote for propaganda are likely to blame for the misattribution.

Naomi for CoinJar

UK residents: Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).