9 factors to consider when deciding which cryptocurrency coins and tokens to invest in

This is a guest blog post by Rowan Crosby. Rowan is an Australian based financial journalist focused on Australian and US equity and commodity markets.

As the world of cryptocurrencies continues to grow on a daily basis, there is more opportunity than ever for investors to buy bitcoin and both well-established and newer cryptocurrencies.

When assessing cryptocurrencies as a pure investment, there needs to be a slightly different approach than with a traditional investment such as a stock. While the value of a stock is largely dependent on its ability to generate profits in the future, cryptocurrency is probably more comparable to an asset like gold. However, while gold is a store of value, cryptocurrencies have far more utility. It’s that level of real-world application that makes this an exciting investment opportunity.

Utility – is there a need for the cryptocurrency to exist?

While we can’t assess a cryptocurrency with the same types of metrics that we might with a traditional company, it is a good idea to gauge how useful the particular cryptocurrency is in the real world.

Is there really any utility? A good way to look at utility is to ask, does this coin/company solve a real-world problem? What is the scale of that problem that needs solving?

An excellent example of a cryptocurrency with utility is Ethereum. While Ethereum is also used as a simple form of payment, arguably its most valuable asset is the ability to implement and execute smart contracts on the Ethereum network. This gives Ethereum both value as a means of exchange, while it is also valuable as it allows for two parties to do business more efficiently.

Ethereum allows developers to program their own smart contracts. A straightforward example might be if one party buys insurance from another. If the terms of the contract are met, the agreed on value gets transferred over the blockchain, cutting out a layer of complexity and cost.

Vision – what’s the purpose and goal?

To really understand its purpose, the best starting point is the whitepaper, often published on the cryptocurrencies official website. This outlines the purpose of the coin or token, written by those who created it. These tend to be a little technical at times, but you can also read more about the various coins on the company blog or ask questions in their Slack channel. If a coin’s whitepaper is flooded with marketing lingo, then that might be a red flag.

Competitors – how does it hold up against similar cryptocurrencies and tokens?

It’s also worth looking at where the cryptocurrency is compared to its competitors. Being first-to-market is a big advantage and it’s one that Bitcoin has ridden to lofty levels. However, each new cryptocurrency that comes to market effectively builds on the weaknesses of the ones before it. EOS is being touted as a problem for Ethereum as it solves some of the scalability issues. This lifecycle needs to be taken into account just as if you were to invest in a company like Kodak instead of Apple.

Team – who are the people behind it?

The team that is behind the coin/token is also incredibly important. What kind of background do they have in the industry and do they have a clear vision? Again it comes back to what the problem that is ultimately being solved.

Supply vs Demand

When we try and gauge the utility of a coin or token, we are looking at the demand side. However, assessing the supply side is a far easier proposition.

If a coin has a finite supply, then over time, the price should theoretically continue to rise as demand dictates. Conversely, if a coin continues to increase the supply, it is effectively diluting its value. Likewise, if a company continues to issue more stock. Theoretically, a coin with a fixed supply of coins will make for a better investment. Assuming the coin has value in the real world.

Bitcoin is an example of a cryptocurrency that has a limited supply. Supply of BTC is controlled by the software and miners are issued with new tokens as they create the next block on the blockchain.

For the first four years, Bitcoin distributed 50 BTC per block. It then halved to 25. And then 12.5. This process is set to continue until 2140, where there will be no more new coins distributed.

Ethereum co-founder Anthony Di Iorio is bullish on Bitcoin, and the supply side is a big reason. “In general, it’s got amazing features and it’s got the ability to, because it’s scarce, be a great utility,” said Di Iorio.

Market Cap

It’s also worth assessing the supply side in terms of the market capitalization of the coin. While market capitalisation is simply a number, what it represents is liquidity. In the world of finance, liquidity breeds more liquidity. That means that it will be easier to buy and sell your cryptocurrency and that encourages others to do the same.

Founder Holdings

Bitcoin is the largest cryptocurrency, followed by Ethereum, Ripple’s XRP, Bitcoin Cash and EOS. It is also useful to see what percentage of the cryptocurrency is held by the founders. Similar to the way we assess a company by looking at if a director is buying or selling their shares, we can do the same with cryptocurrencies.

According to Forbes, co-founder and executive chairman of Ripple, Chris Larsen, holds 5.19 billion of the company’s XRP token and a 17 percent stake in the company. Many people speculate that if a founder doesn’t cash out at the highs, then they believe in the project (Coin). The founders and C-level executives clearly have the best information about the company and it is generally considered a good idea to follow their lead.

Price vs Value

Ultimately, any investment you make in any asset class comes down to the idea of price versus value. Just because a token has a low price, doesn’t mean it is a good investment.

In the stock market, a cheap stock is often cheap because it is a company that isn’t making a profit and is doing their best to simply stay afloat.

We can’t use profits as a measure of value in cryptocurrencies. We need to look at other ideas.

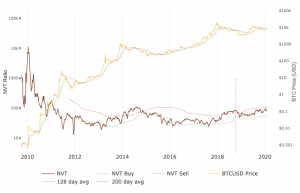

One idea to value Bitcoin is to use the idea of transactions to price. In the same way, we would use a price to earnings or PE ratio in the stock market. We can look at the number of transactions taking place in Bitcoin to see how valuable it actually is as means of making transactions.

If the price is higher relative to the numbers of people actually using it, then it is perhaps overpriced at that moment in time.

Depending on the purpose of the cryptocurrency, this is an interesting way to assess how we might value it. We could apply similar ideas to things like the number of smart contracts.

There are many more elements to assessing if a cryptocurrency is worth investing in. However, the most important question to ask is always, what is the problem it aims to solve?

Diversifying Your Risk

To quote Warren Buffett, “Diversification is protection against ignorance.”

While as investors we do our best to make smart, researched and informed decisions, we still need to make sure we are minimising our risk.

The best way to do that is to be diversified in your holdings. That’s true of the stock market and certainly cryptocurrencies. A great way to do that is to invest in funds that offer exposure to different cryptocurrencies.

Many funds are either weighted by market capitalisation or have a particular focus. This is the fastest and easiest way to invest in this exciting new sector while ensuring you’re not taking on too much risk.

Cryptocurrencies have seen explosive growth in the last few years and as the sector continues to evolve, we are going to see more game-changing technologies come along. By comparing coins to simple businesses, we can gauge if we think the concept might be a valuable idea going forward.

We are not affiliated, associated, endorsed by, or in any way officially connected with any business or person mentioned in articles published by CoinJar. All writers’ opinions are their own and do not constitute financial or legal advice in any way whatsoever. Nothing published by CoinJar constitutes an investment or legal recommendation, nor should any data or content published by CoinJar be relied upon for any investment activities. CoinJar strongly recommends that you perform your own independent research and/or seek professional advice before making any financial decisions.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).