Bitcoin 101 - Lesson 1 - Wallets

Knowledge is power, and knowing how to effectively manage your wallets gives you the power to be your own bank.

We recommend storing your ‘long term’ bitcoins offline, in a paper wallet (this is called cold storage), and keep your every day spending bitcoins on a phone wallet. But before you do that it’s important to learn some key steps.

Below is a breakdown of some key terms and definitions to get you started. Make sure you do research, do a few test wallets first and understand the systems behind it. Not only will this help you guarantee your own safety, it’ll put you at the cutting edge of a new technology.

If you are still asking what bitcoin is, how to buy bitcoin, or how to buy Crypto OTC, maybe start here and then spend a little time here first.

What are Wallets?

Your money is stored in a wallet. It is a long string of code, (an address) that has a corresponding password (a key).

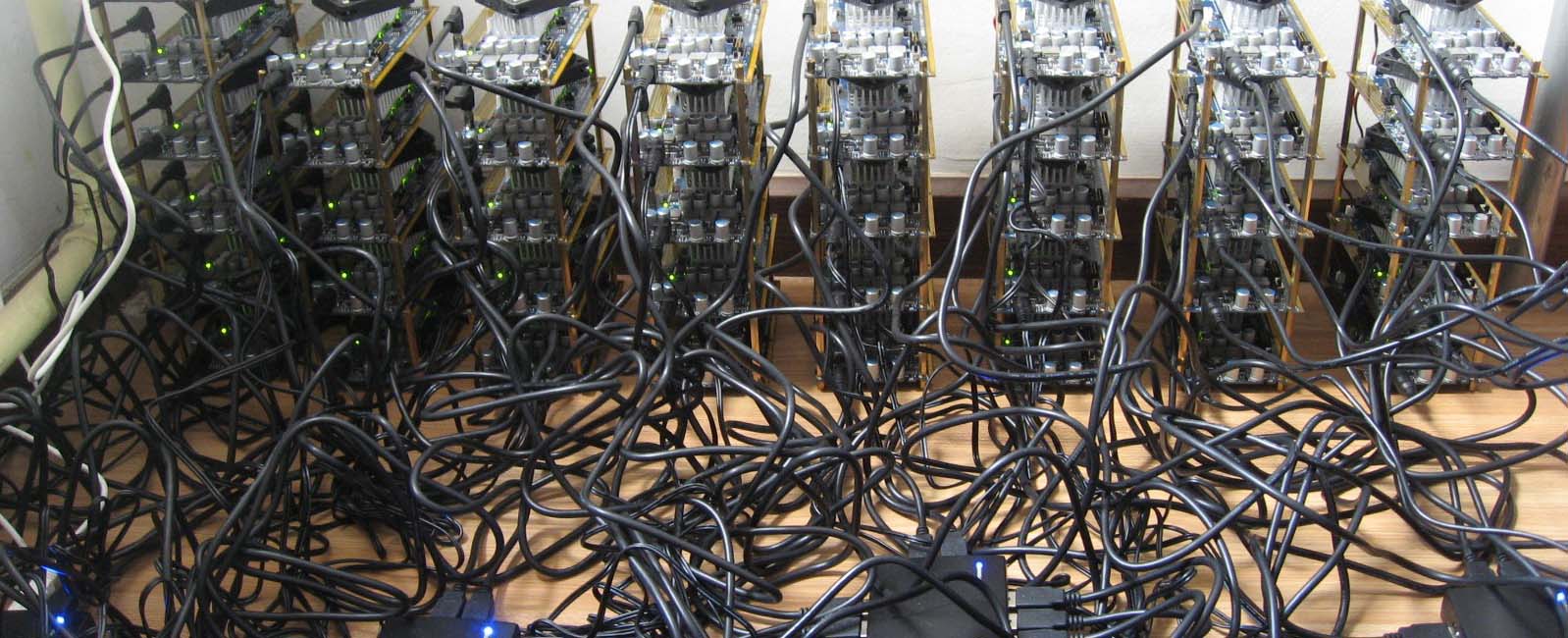

They are connected by the power of ECDSA cryptography and the petaflop strong bitcoin network will only accept the key when told to complete a transaction from an address.

How they work

The address is like your email address, you can hand it out and people can send you bitcoins. Your coins are associated with your wallet address, held in a peer to peer network maintained by miners (the heart of the network mentioned above).

Your key is like the password to your email, it is another long code that looks a lot like a wallet. When you put your address and key into a client you’re able to authorise transactions from your wallet (ie send money). This key needs to be kept safe and out of the hands of hackers, phishing software and robbers in general.

Types of wallets

There are different ways to manage your wallet.

Online wallet

You can hold your address and your key in a client such as an app or a website. This means you only need your password to the client. Often they generate a wallet for you, and sometimes don’t even give you a key at all. These are easy to use but clients can get hacked and giving your key to a third party involves risk.

Coinjar offers a hosted wallet, where you are given an address, and can send receive bitcoins from it. However you aren’t given a “key” and must use the CoinJar interface. It makes a great ‘hot wallet’ for every day purchases, but isn’t recommended for storing large amounts of value.

All third party wallets involve trust. To be your own bank an offline wallet is the best way to go.

Software Wallet

You can use a device with a software client that generates keys and wallets, and manage your funds on it like a bank account. To be extra safe you can keep it offline. No hackers can access a computer that isn’t online so this is pretty safe.

Check out Armory, Bitcoin-QT, or Electrum as ways to generate and host a wallet. All these can be run on an online or offline computer, but remember if your computer is compromised so is your wallet.

The most important thing here is that you backup the wallet file. A USB you can hide away is very safe, anything with the least chance of being accessed by a hacker.

The problem with digital storage is they can be corrupted, deleted or compromised, so the safest way is to store the wallet address and key offline, on paper.

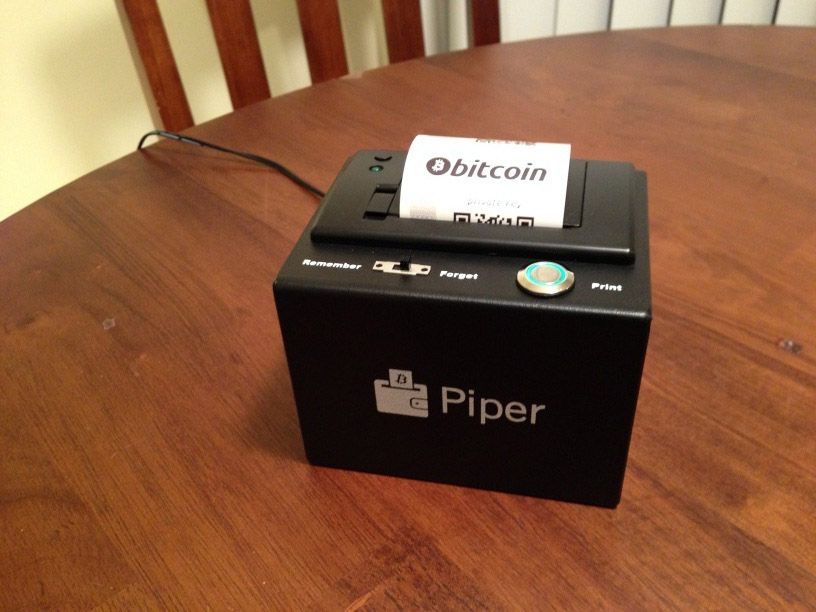

Paper Wallets (cold storage)

A Paper wallet is merely your Address and your Key held on a piece of paper. Technically you could write or print it on anything else, but when people say paper wallet they are referring to their address and key stored non-digitally.

Generating paper wallets can be tricky, as the point is not leaving your key on anything that can be hacked, so if it’s not created the right way, malware could still access the file, or you may have left a trace somewhere.

It’s great for hoarders though as you can give out your wallet address to receive funds, and send money to it, and as long as the key doesn’t go online then it is not vulnerable to hacking.

To give you an idea of its security in bitcoin circles, the bulk of our funds are held offline in paper wallets in a bank vault.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high‑risk investment and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more: www.coinjar.com/uk/risk-summary.

Cryptoassets traded on CoinJar UK Limited are largely unregulated in the UK, and you are unable to access the Financial Service Compensation Scheme or the Financial Ombudsman Service. We use third party banking, safekeeping and payment providers, and the failure of any of these providers could also lead to a loss of your assets. We recommend you obtain financial advice before making a decision to use your credit card to purchase cryptoassets or to invest in cryptoassets. Capital Gains Tax may be payable on profits.

CoinJar’s digital currency exchange services are operated in Australia by CoinJar Australia Pty Ltd ACN 648 570 807, a registered digital currency exchange provider with AUSTRAC; and in the United Kingdom by CoinJar UK Limited (company number 8905988), registered by the Financial Conduct Authority as a Cryptoasset Exchange Provider and Custodian Wallet Provider in the United Kingdom under the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017, as amended (Firm Reference No. 928767).